Rated #1 By Under30CEO for Business Checking in Maine

Because your business deserves the best, we’ve designed our checking solution to support your business every step of the way, with no minimum balance and no monthly service fees.

How can we help you today?

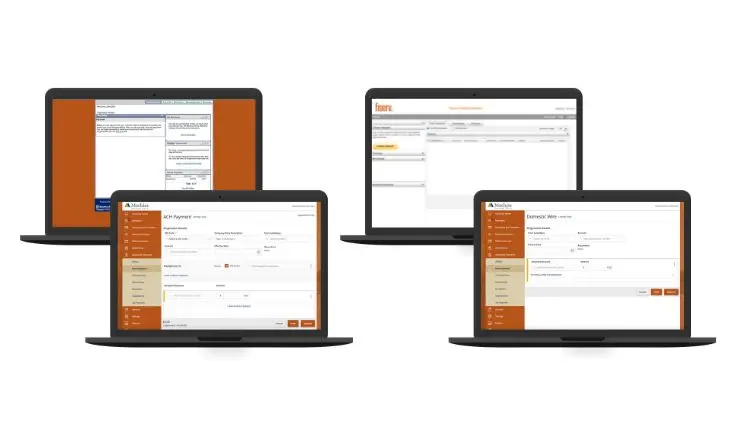

Process Payments Anywhere and Every Way Your Customers Want.

Reach out to our Cash Management team to help you choose the right credit card processor for your small business.

Process Payments Anywhere and Every Way Your Customers Want.

A Credit Card as Unique as Your Business

Keep your business and personal finances separate with our MasterCard® Business Credit Cards.*

A Credit Card as Unique as Your Business

Meet Our Commercial Banking Team

We’re Mainers, just like you, and we believe that when one of us succeeds, we all do. Let us help you find your "Yes!".

Meet Our Commercial Banking Team

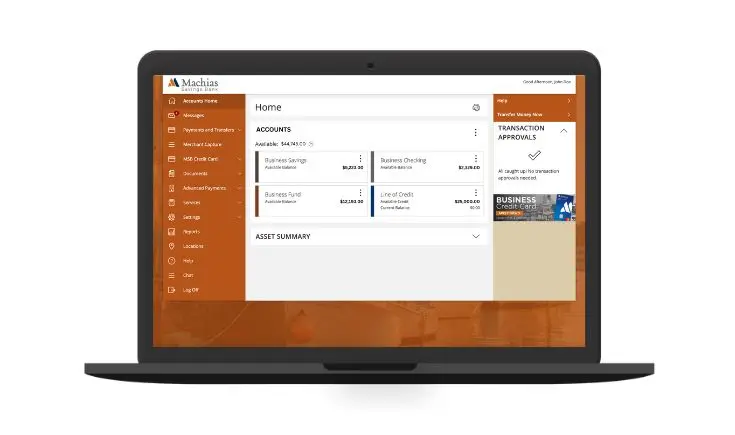

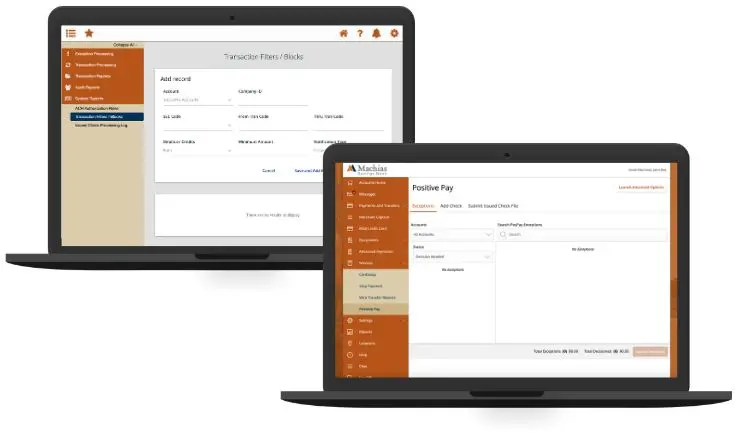

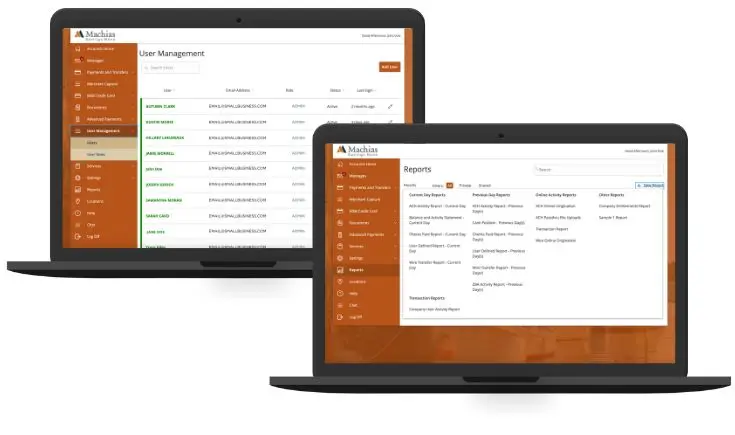

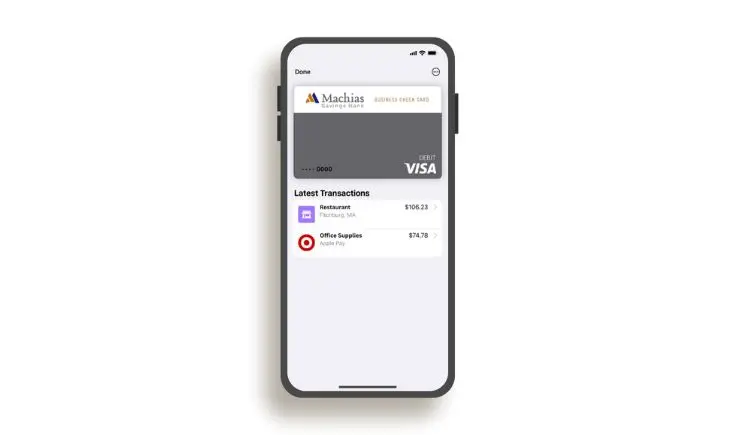

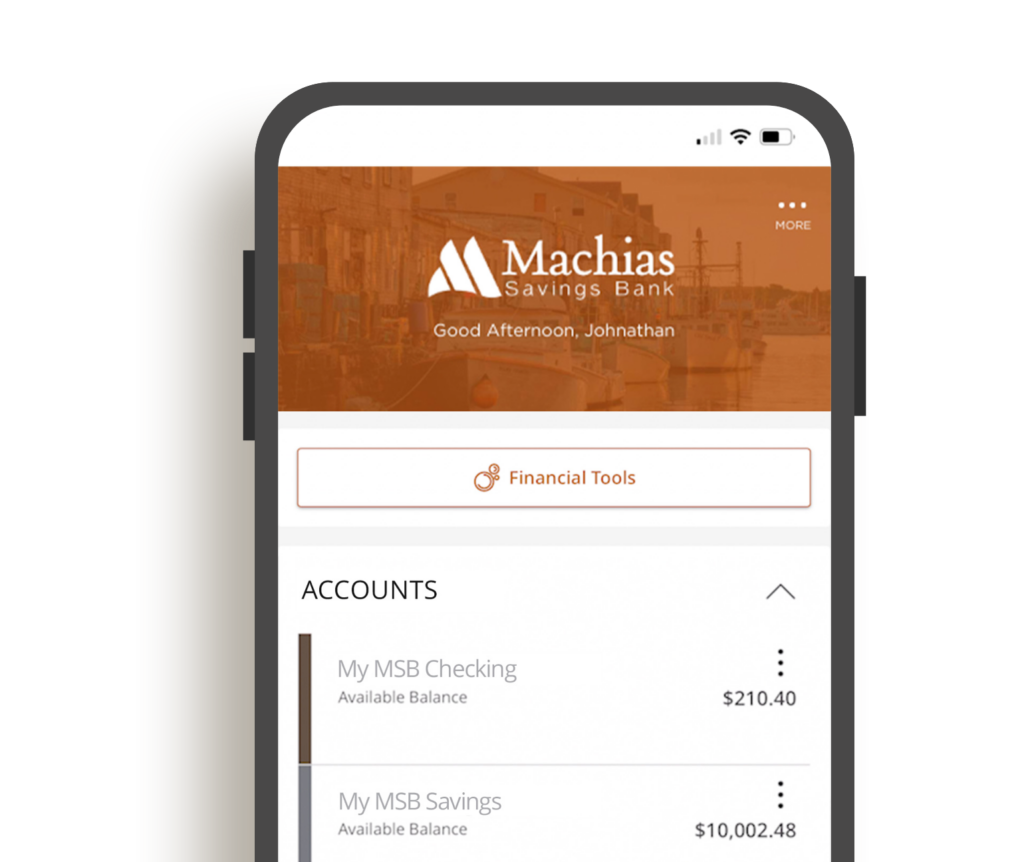

Mobile and Online Banking

Manage your financial information on your mobile device or computer.

Handle Your Finances on the Go

As a small business owner, you need a fast and convenient way to manage your money so you can spend less time worrying about transfers or payroll and more time running your business.

We’re Here to Help

Moving Maine forward, one person, one business and one community at a time.

Our Disclosures

* Member FDIC. Subject to credit approval. Ask for details.

MSB Checking Solutions

A business checking account should cater to your specific business. Whether you need something simple or want to spend more time outside the office, we offer checking account options to fit your needs.

Small Business Loans

Our small business loans can help turn passions into profits, and we tailor our loans to meet your business’s financial needs.

Business Credit Cards

Our business MasterCard® Credit Cards are perfect for anyone with a dream of small business ownership. We offer multiple card options to fit your business.