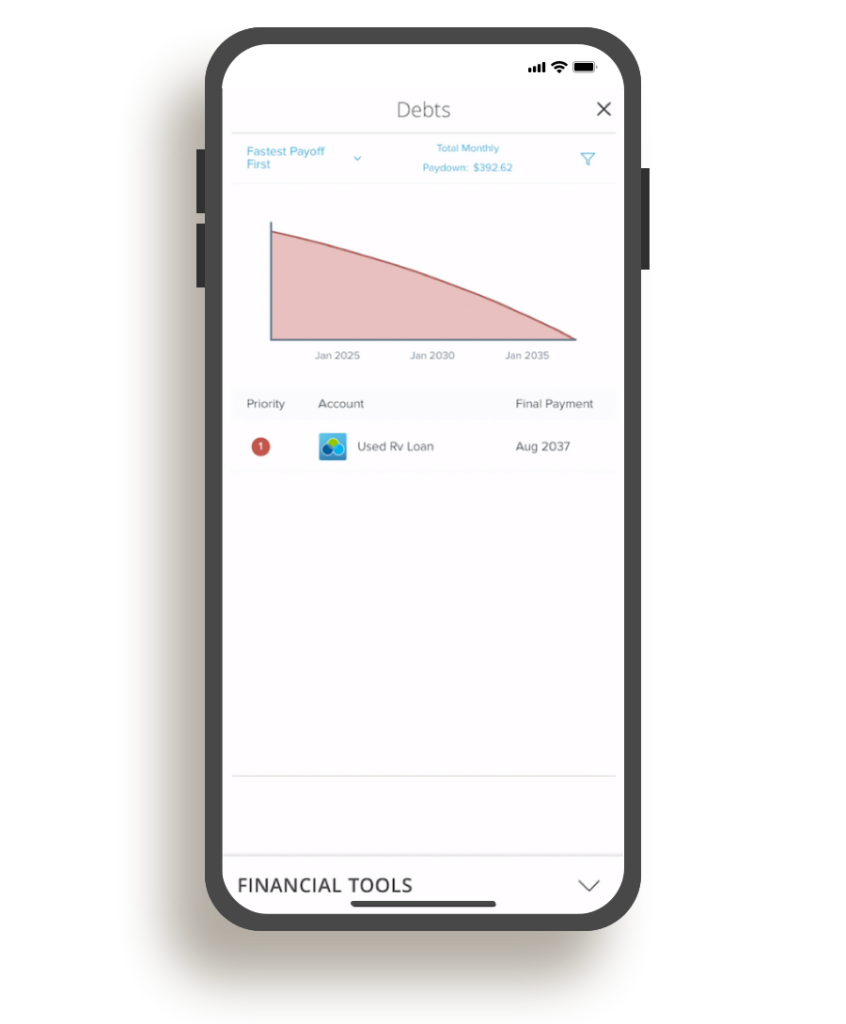

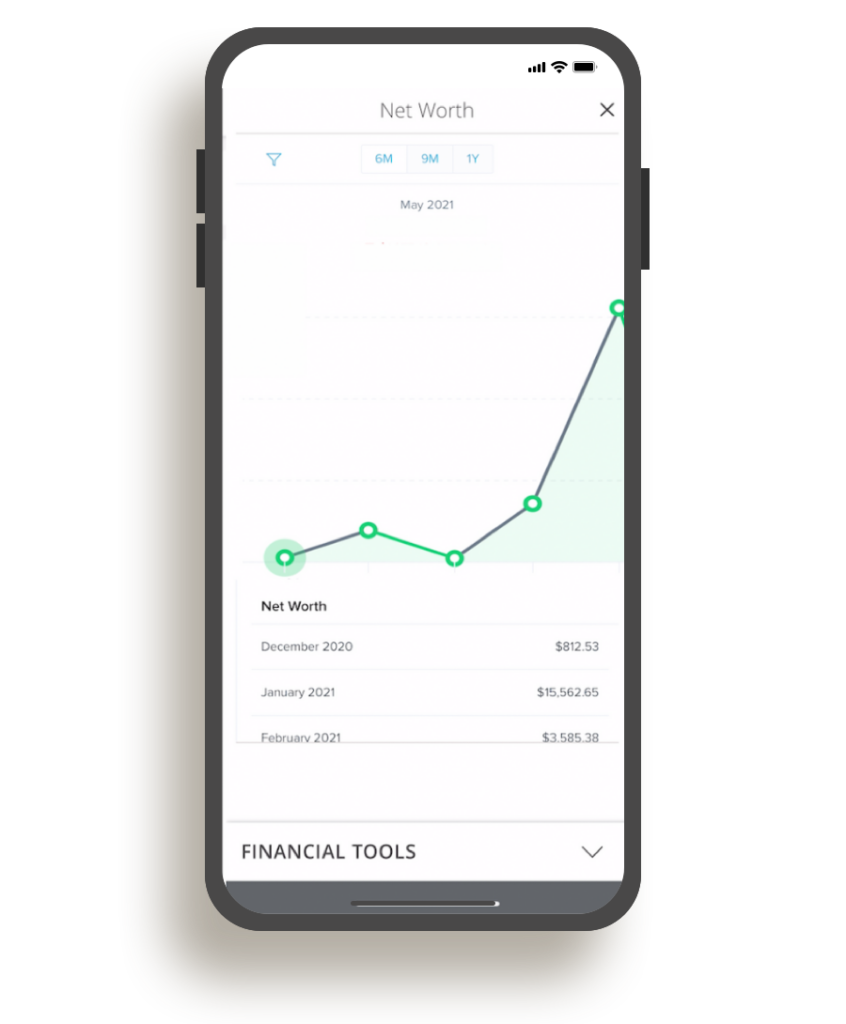

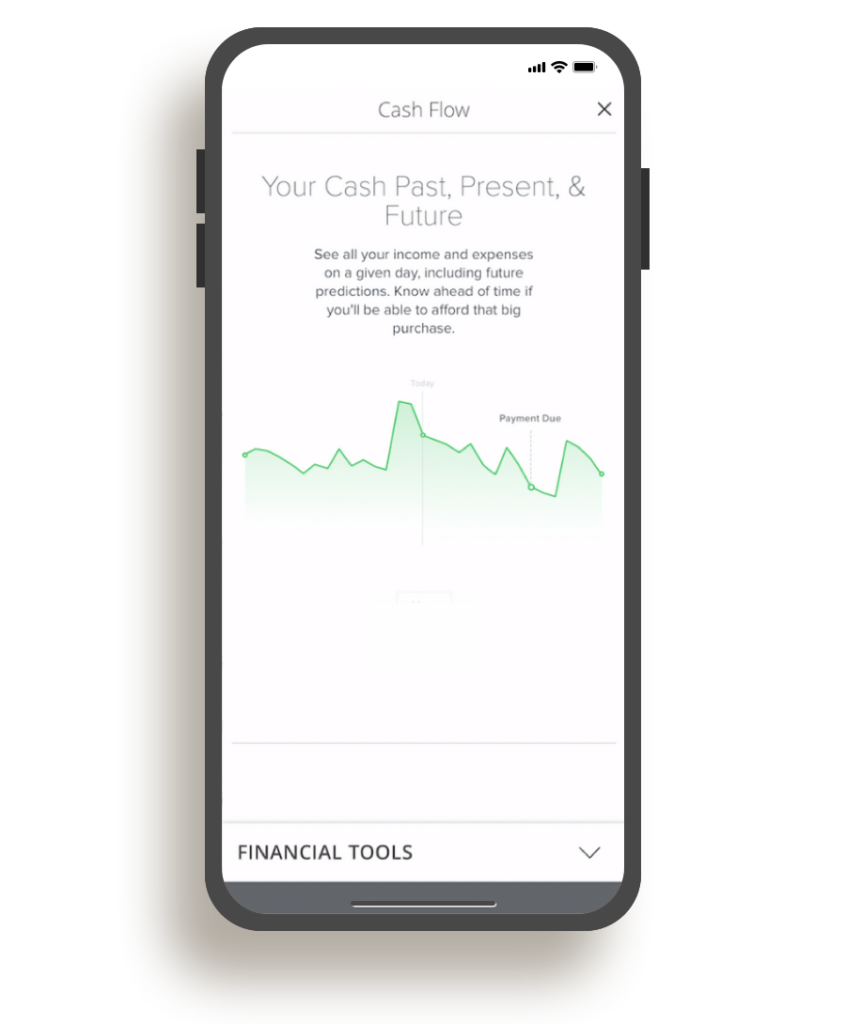

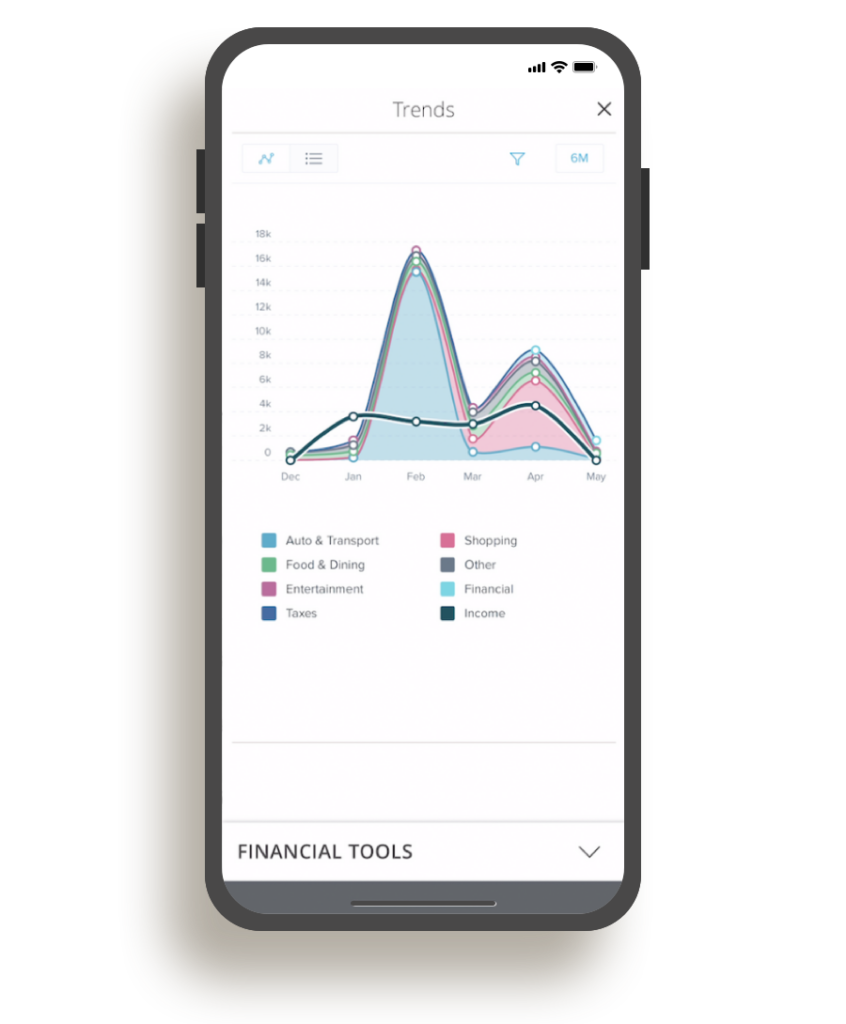

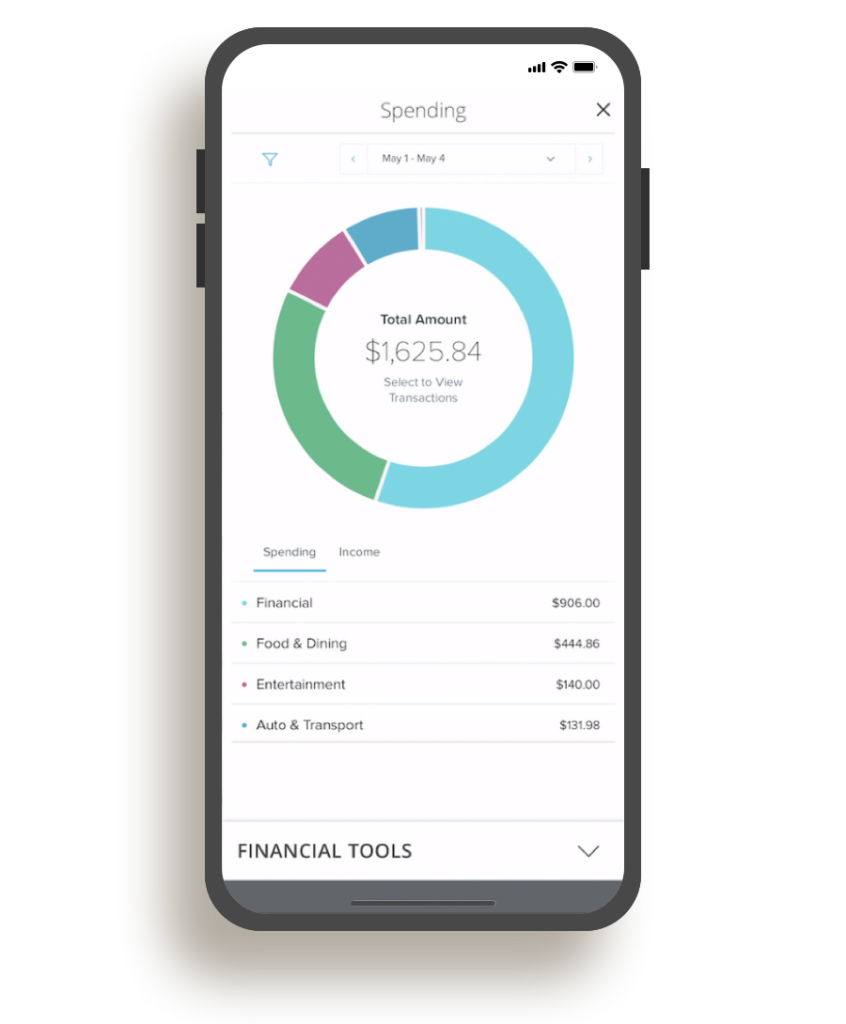

Financial Tools

Your Financial Health Toolbox... Just Got Even Bigger!

We’ve been collecting all the personal finance tools you need to help you build what’s next.

This money management solution has been seamlessly integrated into MSB Online, and now you can securely connect all your accounts including cash, credit, loans, and investments.