Let The Equity in Your Home Work For You!

Remodel your kitchen, add a new room, or use the money for other expenses such as college tuition or anything else you like.

How can we help you today?

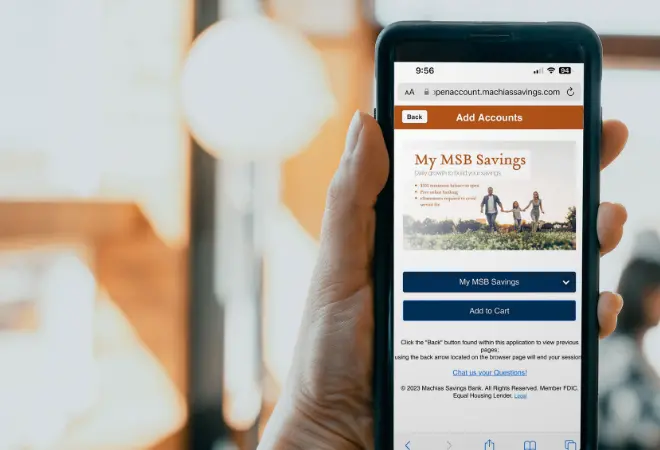

Opening a Deposit Account is Easy

Set up an account from anywhere on any digital device in minutes.

Learn More about checking and savings

Become Part of the Bank of “YES!”

Join one of the best banks to work for in Maine! We invest in our employees and give them the tools needed to succeed in our fun, flexible culture.

Join Our Team See open roles

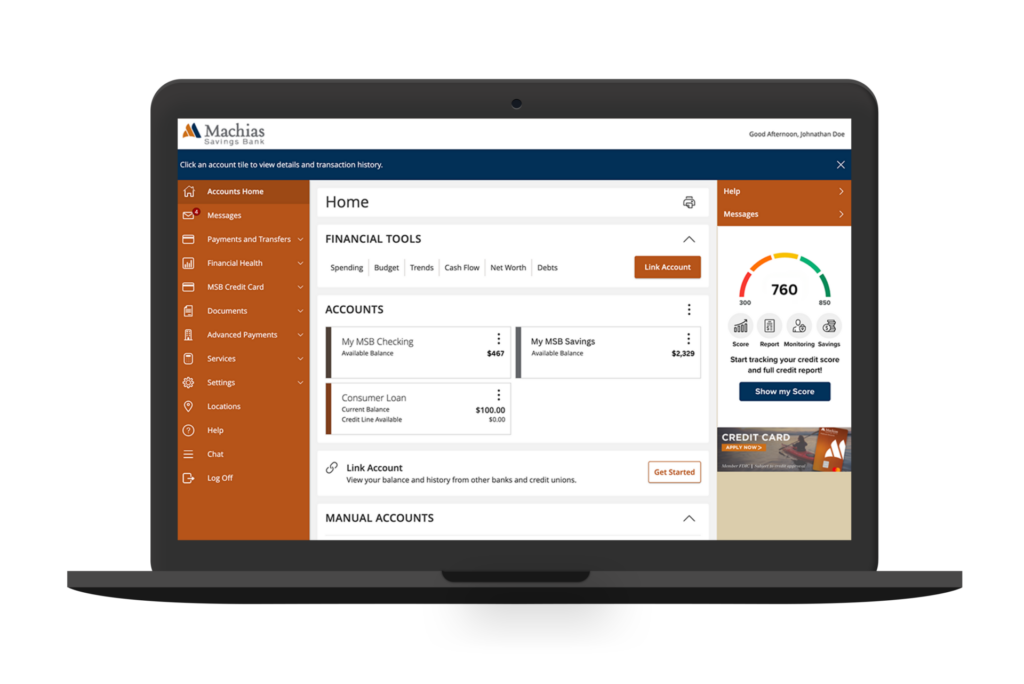

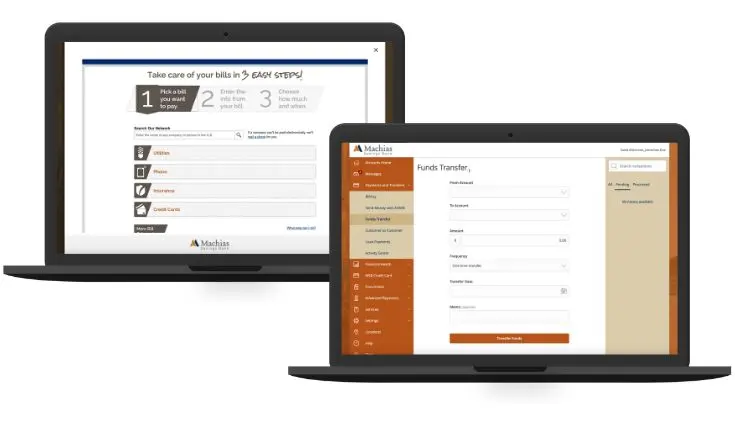

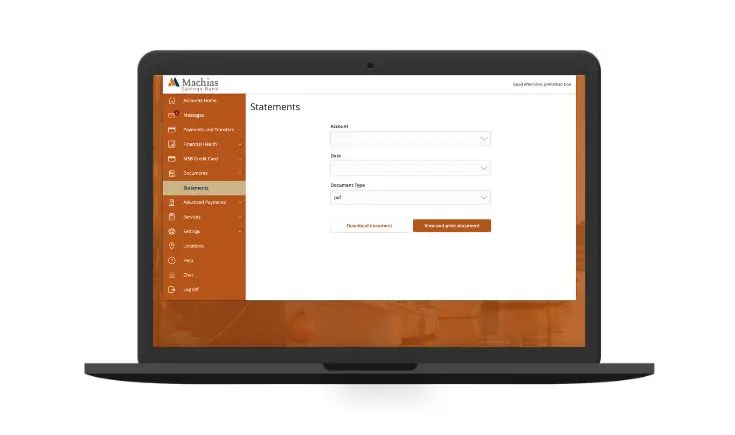

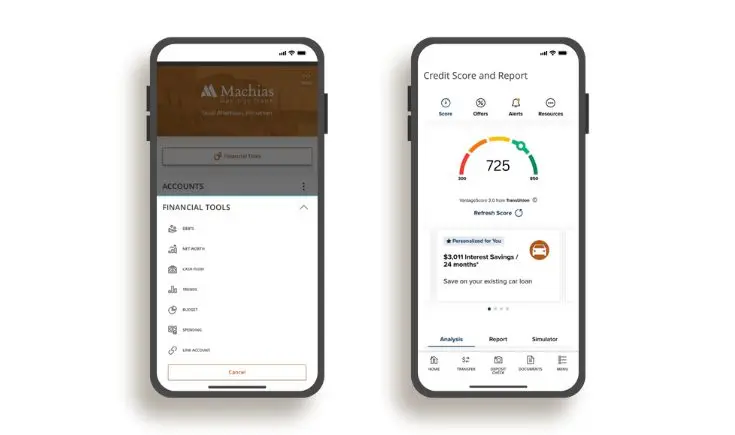

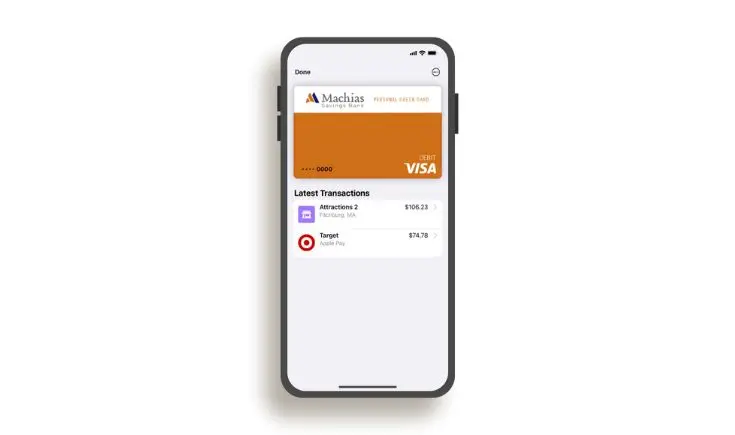

Mobile and Online Banking

Manage your financial information on your mobile device or computer.

MSB Online

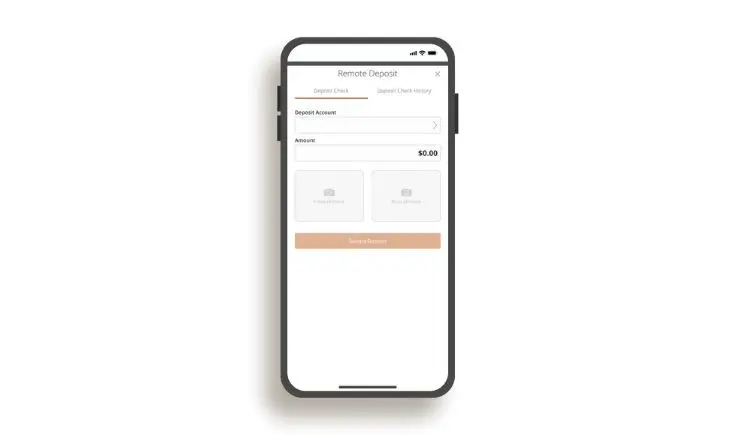

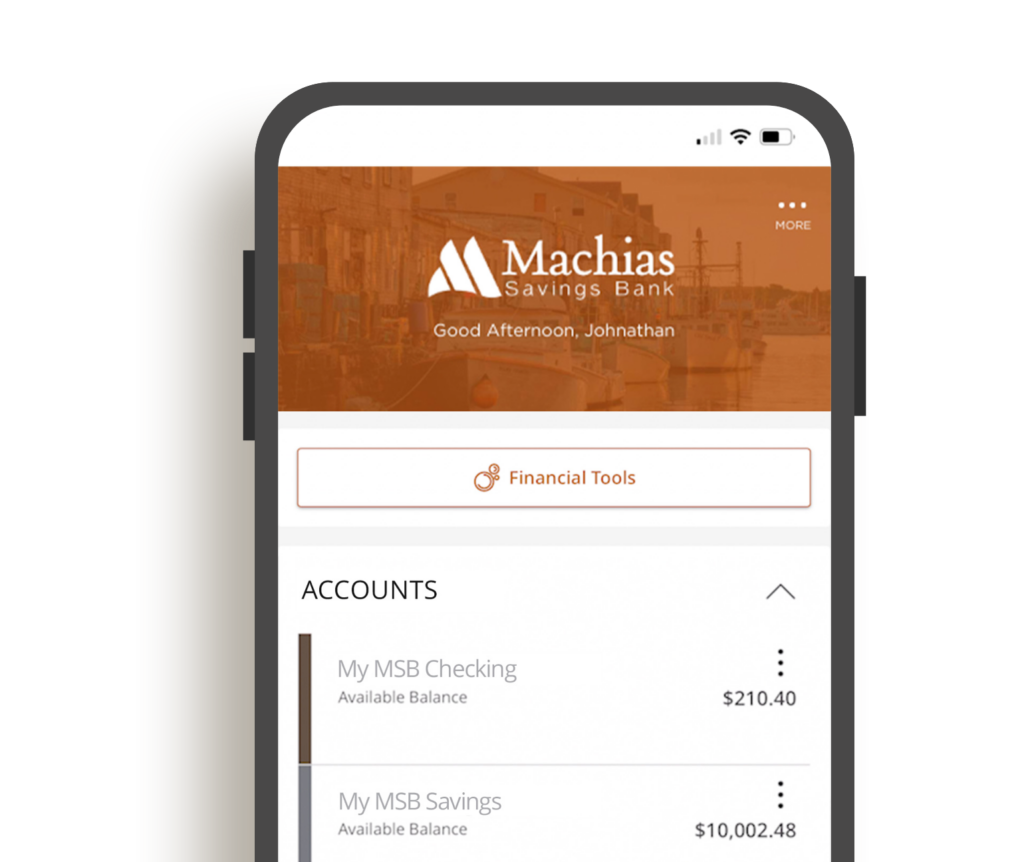

Manage Your Money All in One Place

Download our free mobile app and enjoy having full access to your accounts at your fingertips.

We’re Here to Help

Moving Maine forward, one person, one business and one community at a time.

Our Disclosures

* Member FDIC. Subject to credit approval. Ask for details.

My MSB Checking

Enjoy 5 cents back on every debit card transaction with our My MSB personal checking accounts and out-of-network ATM access rebates.

Save for Special Moments

Savings for a rainy day. A house. Vacation. Future. Whatever you want –your savings account can help you get it.

Home Equity Line of Credit

Our Home Equity Line of Credit is the most convenient way to turn the equity in your home into real money that can turn those wants into reality.